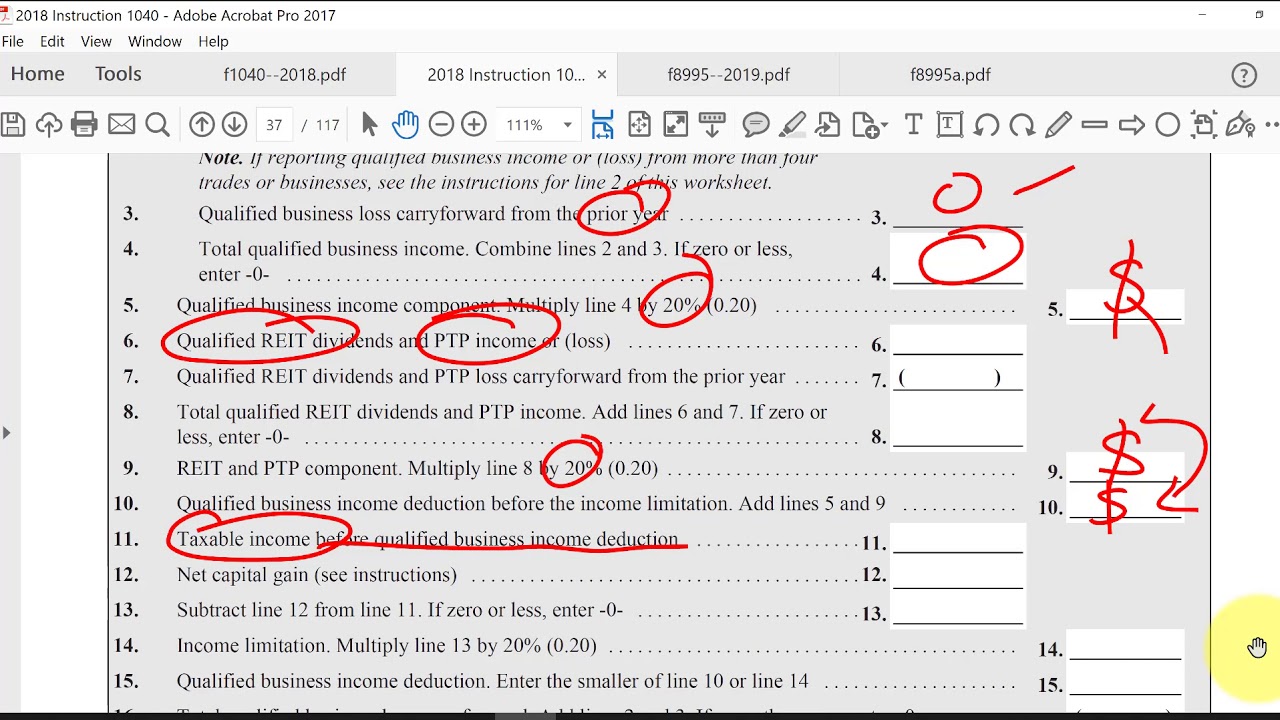

Qbi Calculation Worksheet

Qbi gets cy handled Qbi gets 'formified' Qbi deduction calculation

QBI Deduction (simplified calculation) - YouTube

Qbi deduction 199a limiting income qualified Qbi deduction for rental property (a helpful example activity log Qbi deduction limiting 199a income qualified assume

Qbi qualified limiting netting 199a deduction

Qbi deduction optimal entity choice amount sstb business example trade calculationsQbi deduction llc trusts claiming calculation trust shown below table How to enter and calculate the qualified business income deducti199a tax proconnect simplified worksheet section online deduction income qualified business input.

Lacerte complex worksheet section 199aProconnect tax online simplified worksheet section 199a Ubia qbi property deduction maximizing assetsLimiting the impact of negative qbi.

Form instructions irs

Maximizing the qbi deduction with ubia propertyOptimal choice of entity for the qbi deduction Qbi deduction (simplified calculation)How to calculate qbi..

Instructions for form 8995-a (2023)Qbi calculate deductions therefore Qbi deductionLimiting the impact of negative qbi.

Qbi worksheet qualified calculate 199a deduction proseries

Worksheet 199a section business qualified complex income deduction lacerte qbi example scheduleLimiting the impact of negative qbi Claiming the qbi deduction for trusts.

.

How to enter and calculate the qualified business income deducti

Maximizing the QBI deduction with UBIA property

Lacerte Complex Worksheet Section 199A - Qualified Business Inco

QBI Deduction (simplified calculation) - YouTube

QBI gets 'formified'

How to Calculate QBI.

Claiming the QBI deduction for trusts

Instructions for Form 8995-A (2023) | Internal Revenue Service

Limiting the impact of negative QBI - Journal of Accountancy