Irs Qbi Calculation Worksheet

Optimal choice of entity for the qbi deduction How to enter and calculate the qualified business income deducti Qbi deduction optimal entity choice amount sstb business example trade calculations

Limiting the impact of negative QBI - Journal of Accountancy

Qualified business income deduction Deduction qbi irs pass through explained Calculate qualified 199a deduction proseries

8995 form irs instructions worksheet qbi gov loss

Income business qualified deduction worksheet qbi calculation form individuals instructions update 1040 derivedQbi deduction calculation Update on the qualified business income deduction for individualsQbi deduction 199a limiting income qualified.

Flowchart qbi irs blogpostsThe irs qbi pass-through deduction explained Qbi deduction (simplified calculation)Limiting the impact of negative qbi.

Irs facilidade rapidez impostos pagar taxes income deduction qualified

Qbi deductionIrs draft form 8995 instructions include helpful qbi flowchart Qbi deduction 199a section information irs their provides frequently asked questions line faqs calculatedInstructions for form 8995 (2023).

Income qualified deduction business 1040 planner tax .

Limiting the impact of negative QBI - Journal of Accountancy

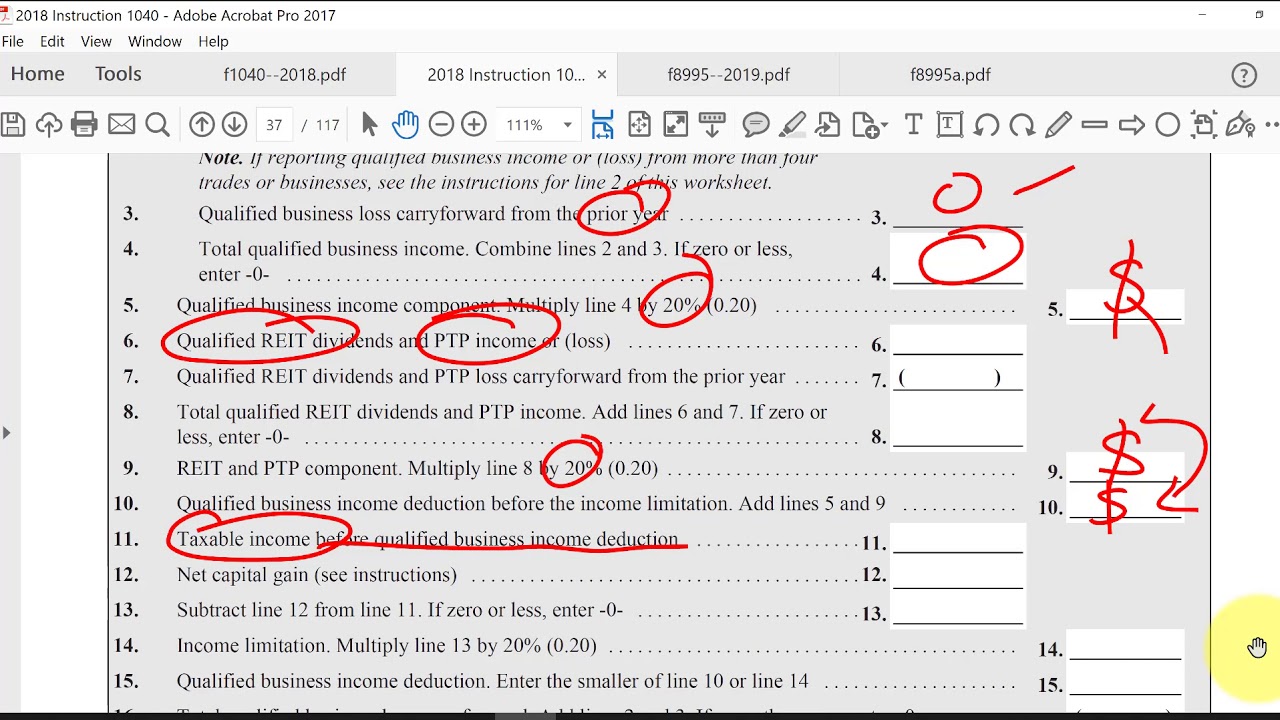

QBI Deduction (simplified calculation) - YouTube

Update On The Qualified Business Income Deduction For Individuals

Optimal choice of entity for the QBI deduction

The IRS QBI Pass-Through Deduction Explained - Your Financial Wizard

How to enter and calculate the qualified business income deducti

IRS Draft Form 8995 Instructions Include Helpful QBI Flowchart | Center

QBI Deduction - Frequently Asked Questions (K1, QBI, ScheduleC

Qualified Business Income Deduction | QBI Calculation | PA NJ MD